A calendar spread is a trading strategy that involves buying and selling options or futures contracts with different expiration dates but the same underlying asset. This strategy is often used to take advantage of differences in time decay and volatility between the two contracts.

Our approach adapts this concept to the cryptocurrency derivatives market by combining perpetual futures and quarterly futures in an arbitrage framework. By simultaneously entering opposite positions on perpetual and quarterly contracts, we are able to:

- Leverage capital efficiently — the offsetting nature of positions allows us to apply high leverage with significantly reduced liquidation risk.

- Exploit funding rates — perpetual futures include a funding mechanism that redistributes capital between long and short positions. We forecast the total funding payments expected until the quarterly contract’s expiry and use this projection to guide our positioning.

- Capture the spread — when the projected funding is low, our focus shifts toward profiting from the price spread between perpetual and quarterly futures. Conversely, when funding is expected to be high, we optimize for collecting these payments instead.

To refine entries, we rely on moving averages of both the spread and realized funding, combined with a protective epsilon threshold. This buffer ensures that positions are only taken when the expected edge is strong enough to compensate for potential volatility and noise.

The result is a robust strategy that balances two profit sources—spread convergence and funding arbitrage—while maintaining disciplined risk management.

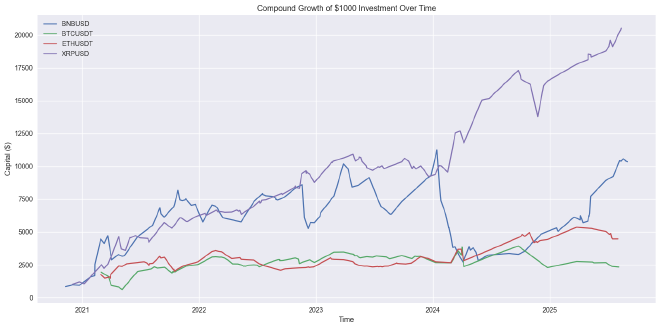

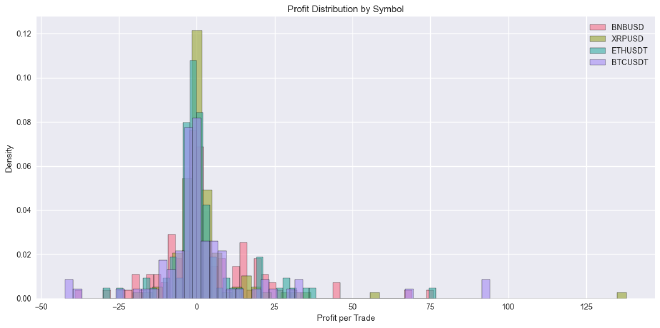

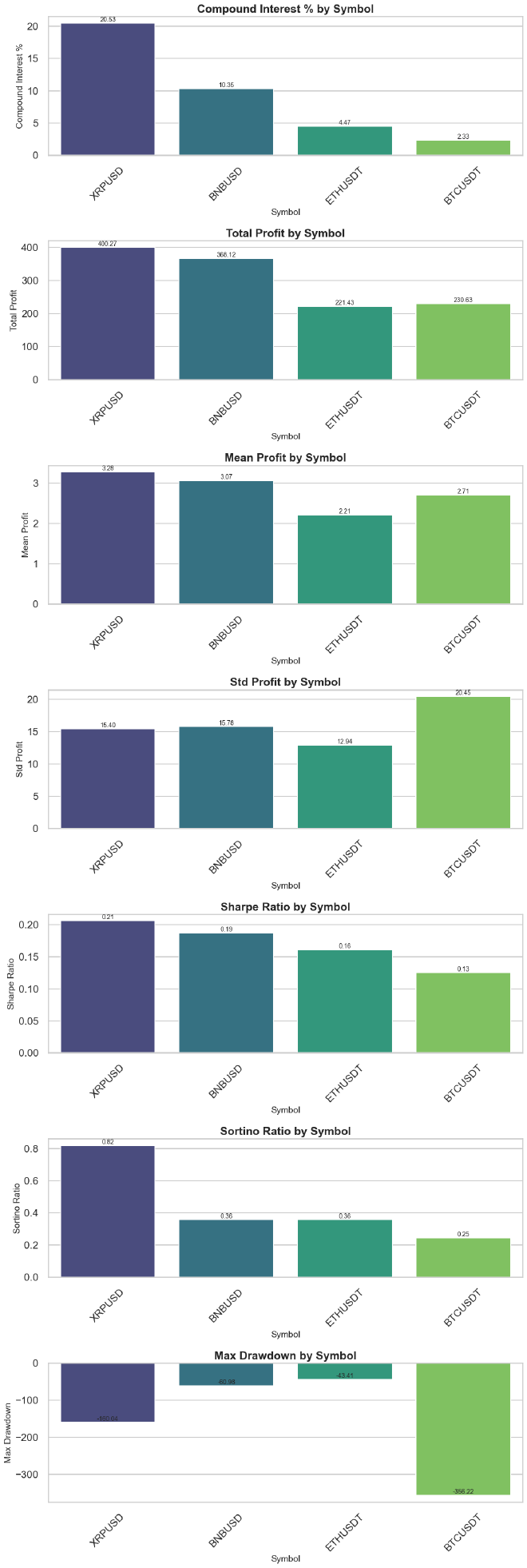

While the concept of calendar spread arbitrage is grounded in risk reduction, the true strength of our strategy is best illustrated through data. By combining perpetual and quarterly futures, optimizing for both funding income and spread convergence, and applying disciplined entry thresholds, we achieve consistent returns with limited downside exposure.

Over multiple quarters of live and backtested trading, the strategy has demonstrated:

- Stable profitability even in volatile market conditions

- Low drawdowns compared to directional trading approaches

- Attractive risk-adjusted returns, with Sharpe and Sortino ratios exceeding industry benchmarks

The following charts highlight key performance metrics, including cumulative returns, funding income versus spread capture, and quarterly performance stability.